Intel shares down 13% as company only manages to shrink losses in latest earnings, demand to outpace 2026 supply — $300 million deficit comes despite more than $20 billion in outside investment from Nvidia and friends

Financial injections helped Intel in 2025, but what about supply constraints in 2026?

Get 3DTested's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

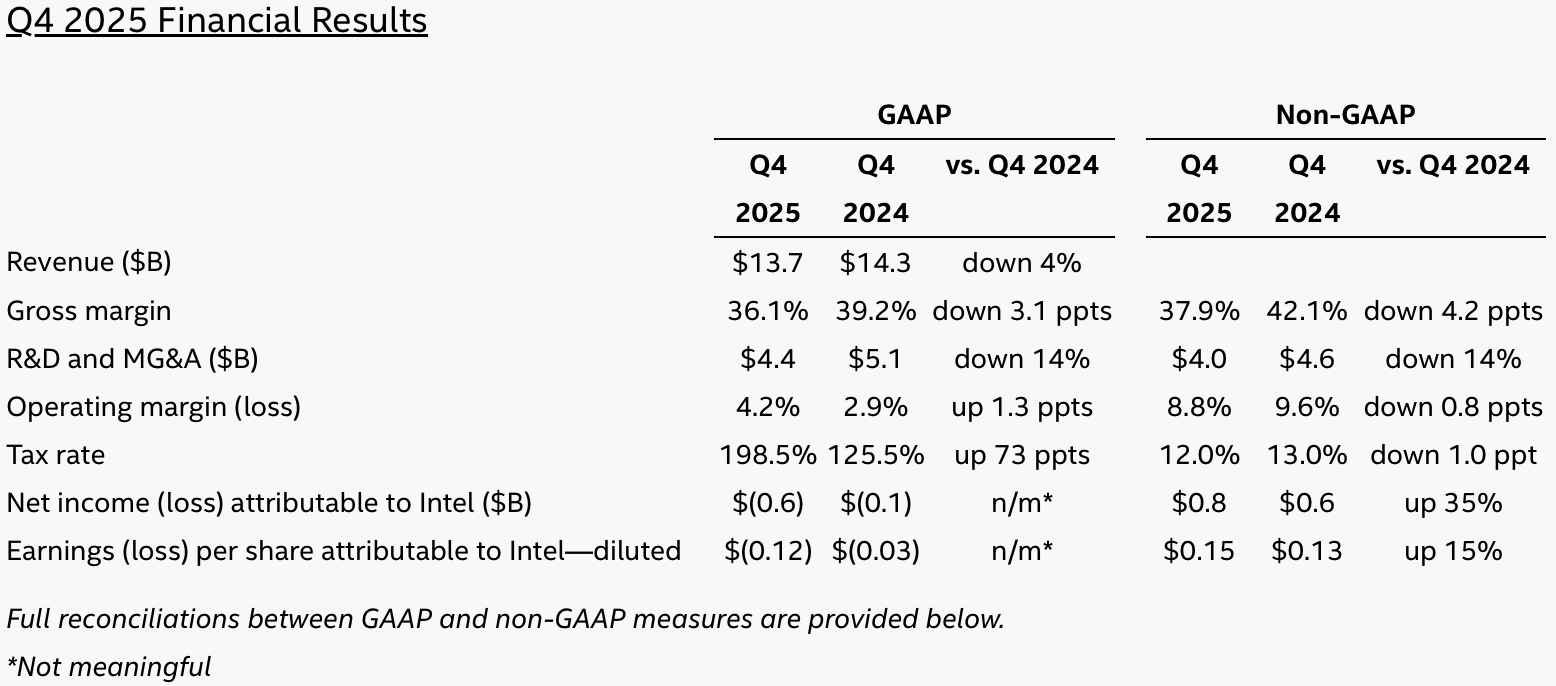

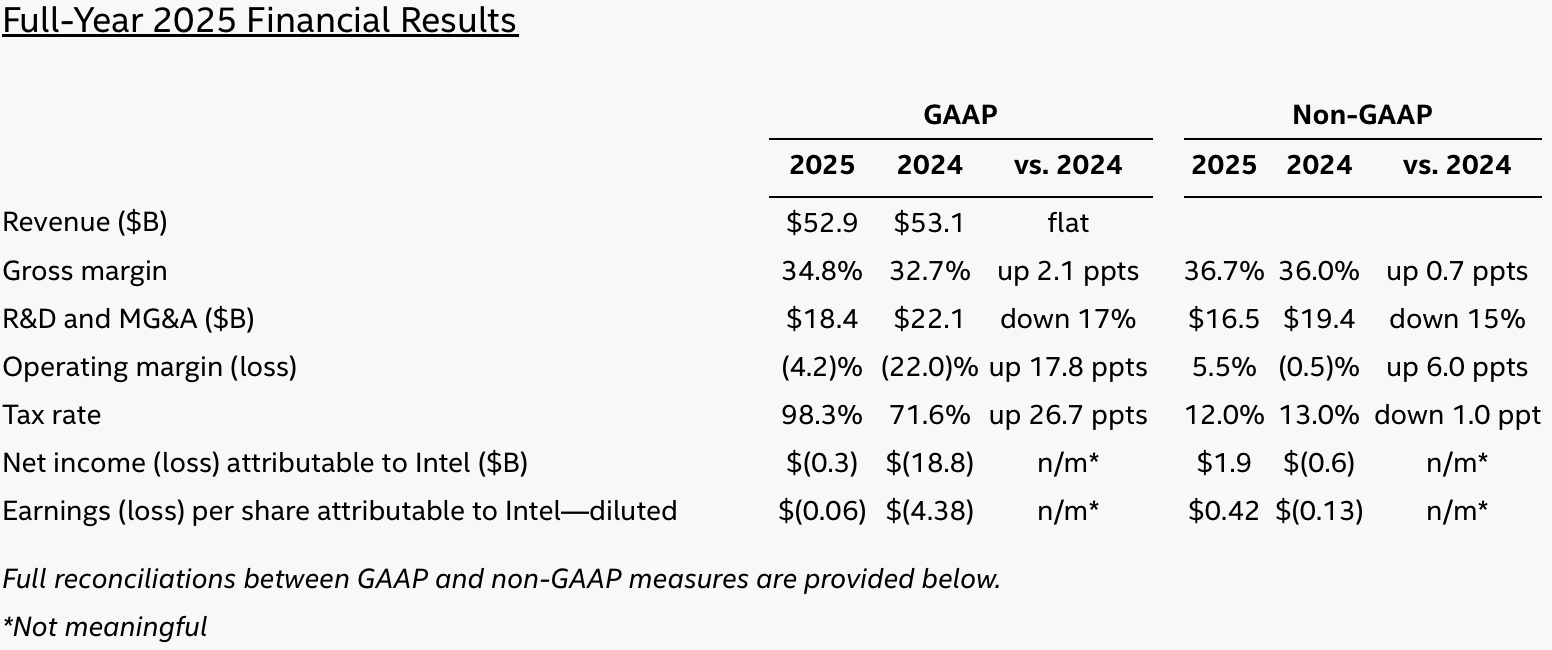

Intel reported its financial results for the fourth quarter and full year of 2025, closing the year with $52.9 billion in revenue, its weakest annual result since 2010. Despite earnings declines both in Q4 and for the whole year, Intel says that its earnings in the fourth quarter exceeded expectations as demand outstripped supply, due to the ongoing AI buildout.

Furthermore, the company reports a GAAP net loss of $300 million in 2025. Compared to its staggering $18.8 billion loss in 2024, this can be framed as a breakthrough. However, this is not quite yet a turnaround, as the result came with important caveats.

"We exceeded Q4 expectations across revenue, gross margin, and EPS even as we navigated industry-wide supply shortages," said David Zinsner, chief financial officer at Intel. "We expect our available supply to be at its lowest level in Q1 before improving in Q2 and beyond. Demand fundamentals across our core markets remain healthy as the rapid adoption of AI reinforces the importance of the x86 ecosystem as the world’s most widely deployed high-performance compute architecture."

In Q4 2025, Intel earned $13.7 billion in revenue, unchanged from the previous quarter and down 4% year-over-year (YoY), as the company's shipments were constrained by wafer supply from its own fabs and TSMC. Due to strong competition and unfulfilled demand, the company reported a GAAP loss of $600 million for the quarter, as gross margin declined to 36.1%, compared to 39.2% a year earlier. For the full year, revenue was $52.9 billion, essentially flat compared to 2024, but gross margin improved to 34.8%.

However, Intel's near breakeven result was made possible by roughly $20.4 billion in external financial injections, including $2 billion from SoftBank, $4.46 billion from Silver Lake (for a 51% stake in Altera), $5 billion from Nvidia, and $8.9 billion from the U.S. Government. Even with external funding, Intel still ended the year in the red, but without the injections, its losses would have deepened.

Operational performance

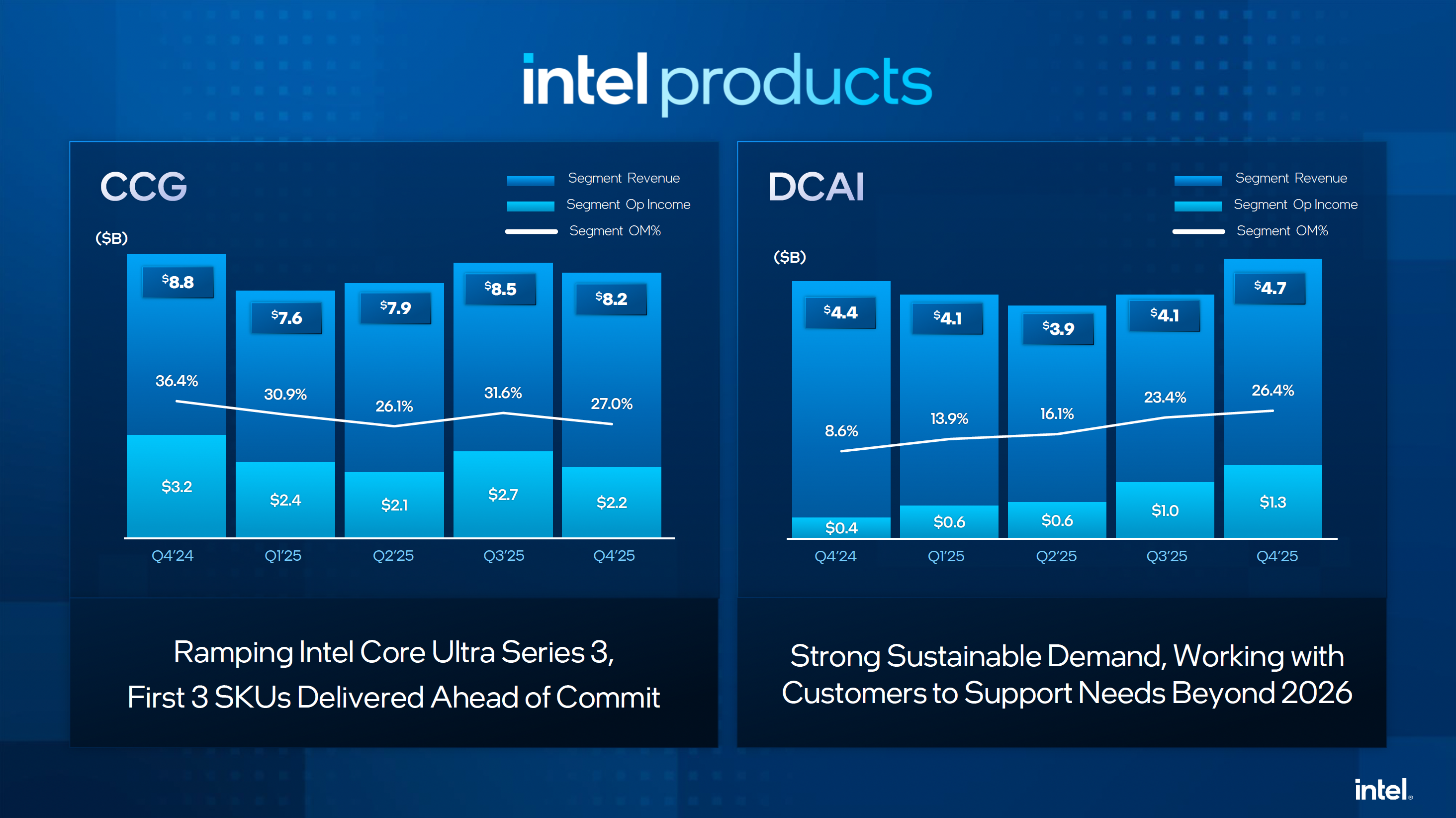

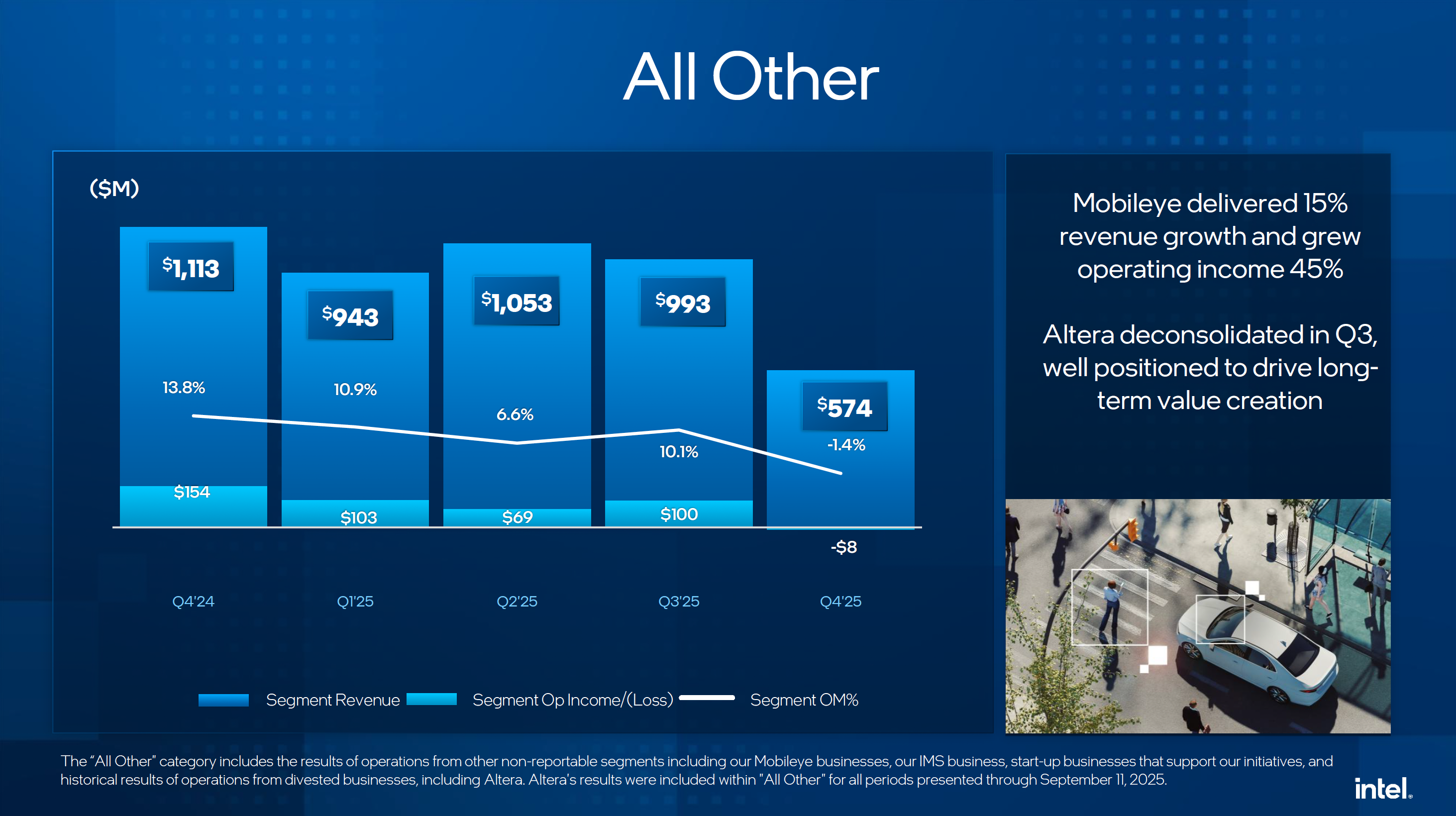

Taking a closer look at different business units, performance varied across business segments. The Client Computing Group (CCG) posted $8.2 billion in Q4 revenue, down both sequentially and YoY, its operating income declined to $2.2 billion as operating margin dropped to 27%. While client CPU demand in Q4 was traditionally very strong, Intel deliberately redirected constrained internal wafer capacity toward higher-margin data center products, thus increasing reliance on externally sourced wafers for client processors, which hit margins of the CCG business unit badly.

Meanwhile, this strategy benefited the Data Center and AI Group (DCAI), which posted $4.7 billion in Q4 revenue, up 15% sequentially and 7% YoY. Operating income surged to $1.3 billion, lifting margins to 26.4%, a dramatic improvement from 8.6% a year earlier and the best result for DCAI in quarters. Again, Intel had to acknowledge that demand for Xeon processors exceeded supply and expects this imbalance to persist into 2026 due to demand from the AI segment.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

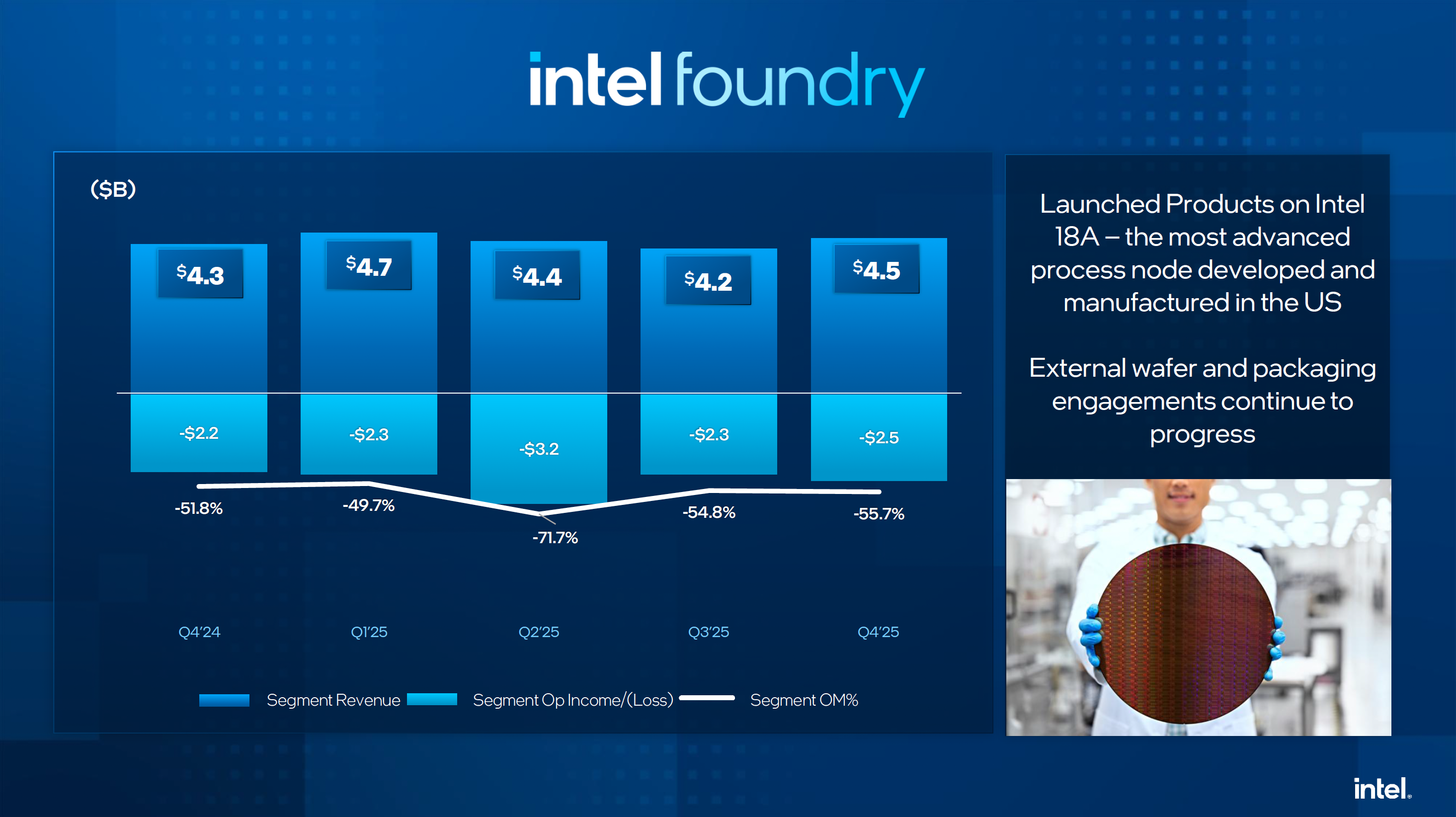

Intel Foundry generated $4.5 billion in Q4 revenue, up 6.4% sequentially, supported by growing shipments of Intel 3-based Xeon 6 CPUs, Intel 4-based Arrow Lake, and (to a minimal degree) early Panther Lake wafers. EUV-based processes now account for over 10% of foundry revenue, up from less than 1% in 2023. However, as usual, the foundry business posted a $2.5 billion operating loss due to a mix of factors, including ongoing capacity investments and the early ramp-up of Intel's 18A.

Q1 2026 outlook

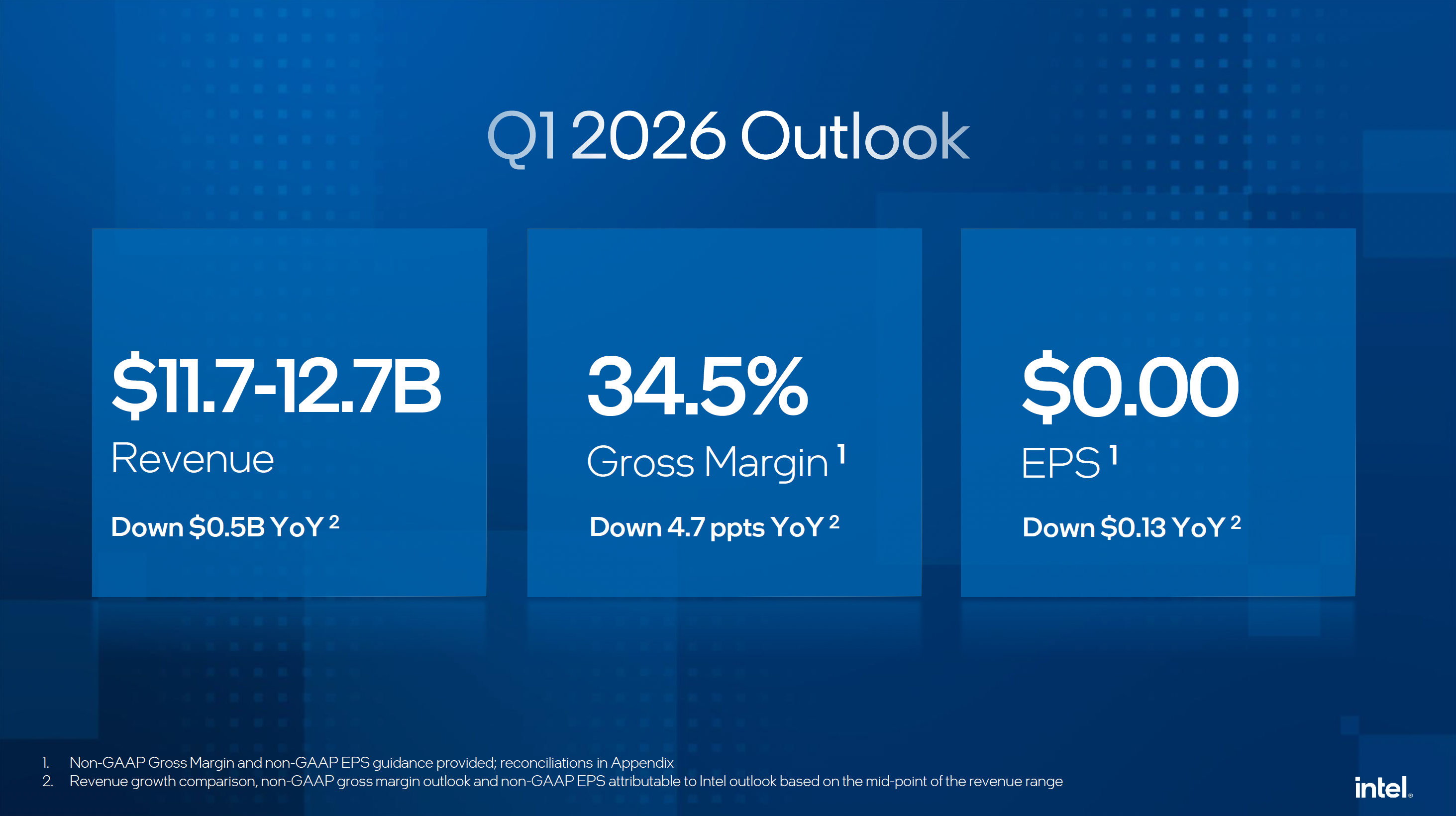

Looking ahead into the first quarter, Intel forecasts revenue of $11.7 billion – $12.7 billion, which is down from the same quarter a year ago.

The prediction stems from continued supply constraints and the lack of buffer inventory that Intel sold in Q3 and Q4 2025. As a consequence, Intel will sell whatever it can get throughout the first quarter of 2026, something that inevitably hits margins, and they are projected to decline to 32.3% (as it will be harder to get as many of the premium SKUs out as possible). The good news is that the company's management expects supply conditions to improve starting in Q2.

Follow 3DTested on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

-

Gururu Reply

The AI bubble pops and then all the companies come begging the consumer for forgiveness with low prices and full inventory. Can it happen?LordVile said:And then the AI bubble pops this year and it goes under -

LordVile Reply

You think people will be buying anything in a recession whilst being laid off?Gururu said:The AI bubble pops and then all the companies come begging the consumer for forgiveness with low prices and full inventory. Can it happen? -

Gururu Reply

I know people living in shacks and driving beaters with iphones and starbucks in hand.LordVile said:You think people will be buying anything in a recession whilst being laid off? -

phead128 When even TOILET companies are profitable in AI chip making business, and you have Intel that literally can't get it's shit together (no puns intended)....the gross incompetence is really stunning.Reply -

TerryLaze Reply

Those numbers do not include any external moneyAdmin said:Intel earns $52.9 billion in revenue for 2025, which is flat with the previous year, and losses of $300 million, which looks good compared to an $18.8 billion loss in 2024. However, to post such results, the company had to get external financial injection of $20.4 billion.

Intel shares down 13% as company only manages to shrink losses in latest earnings, demand to outpace 2026 supply — $300 million deficit comes despi...: Read more

The external money shows up here, with a net win of 26milions, not much but they are still building FABs...Admin said:Even with external funding, Intel still ended the year in the red, but without the injections, its losses would have deepened.

(Gains) losses on divestitures

5,323

Proceeds from divestitures, net

6,157

Net proceeds attributed to common stock and warrants issued, and Escrowed Shares 1 12,760

-

TechieTwo Intel will get another $20 Billion of tax payer funds to hold them over for another year. It's outrageous and dangerous to prop up badly managed companies that get into financial trouble from their own financial greed and arrogance.Reply -

-Fran- "Look at all that tax payer money being tossed down the drain, ma'!"Reply

Jensen has the money to burn, so I wonder when he'll say "move over Lip Bu Tan; I'll take over".

That is one scary thought.

Regards:P -

Gururu Reply

Totally agree. Have to take it to the voting booth!TechieTwo said:Intel will get another $20 Billion of tax payer funds to hold them over for another year. It's outrageous and dangerous to prop up badly managed companies that get into financial trouble from their own financial greed and arrogance.