The U.S. Government is considering tariff exemptions for TSMC if it fulfills its commitment to American investment—$165 billion has already been promised to boost production capacity, though specifics of the agreement remain unclear

The scale of the tariff exemptions will be tied to the scale of the investment, too.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

After the announcement of impending chip import tariffs in January, the Trump Administration is now preparing to grant major U.S. Tech firms such as Google, Microsoft, and Amazon the power to circumvent them. However, the count of TSMC-made chips exempt from the tariffs could hinge directly on how much the Taiwanese chipmaker invests in its U.S. Operations.

This aligns with recent trade negotiations between the U.S. And Taiwan, where the Trump Administration committed to reducing tariffs on imports from the island from 20 percent to 15 percent, provided Taiwanese firms invested $250 billion in the American semiconductor industry, particularly chip manufacturing within the U.S. Shores.

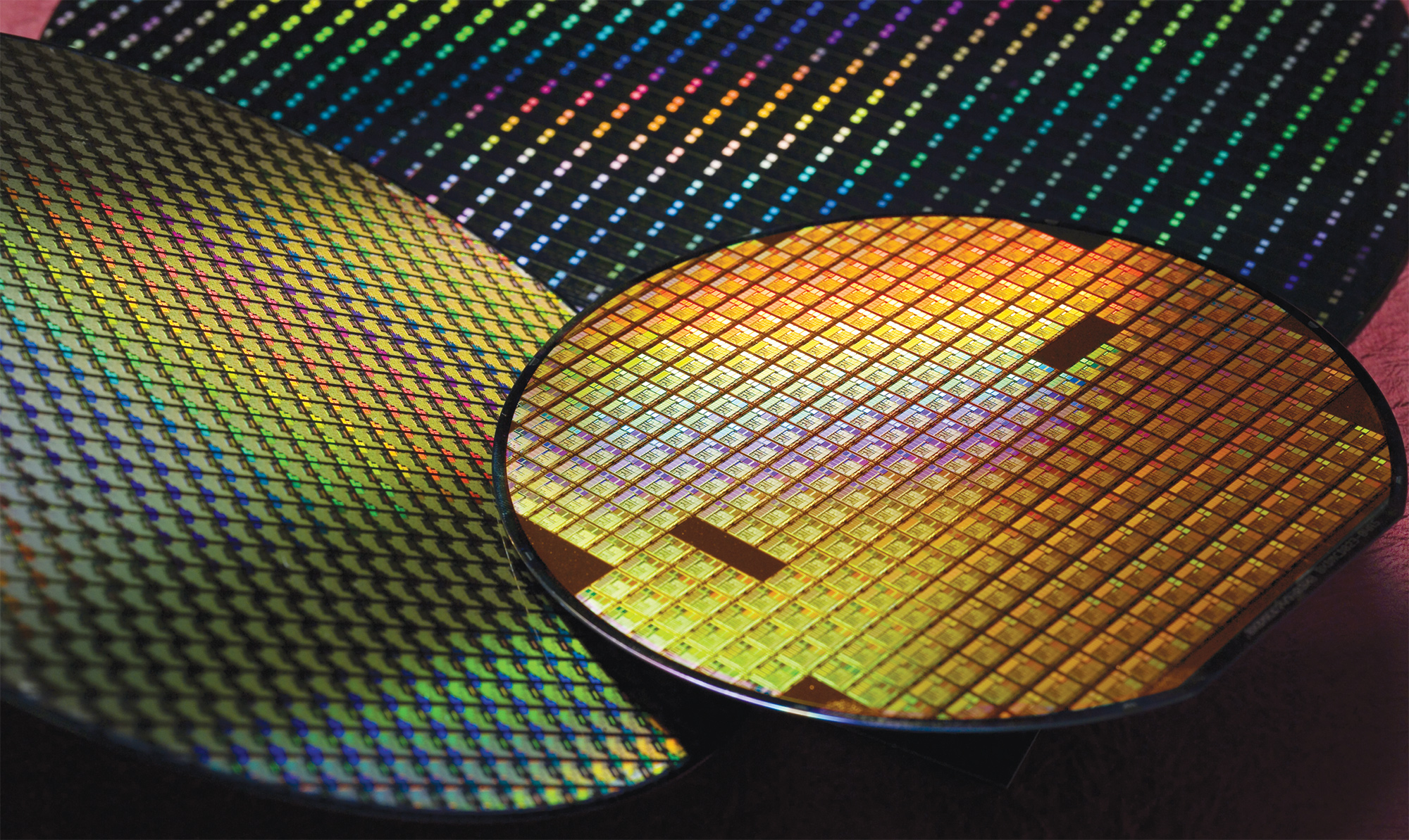

With TSMC as Taiwan's (and the world's) leading cutting-edge semiconductor producer, most of this investment must originate from its own funds. According to Financial Times's sources, the scale of those U.S. Investments still demand considerable effort to map out, and the tariff exemptions add yet another complication for the company to resolve.

We’ll be watching closely what happens after this is revealed, like hawks, to ensure the integrity of our goals with the tariffs and rebates isn’t compromised and that this doesn’t end Ended up being a concession to TSMC,” an official told the Financial Times.

In recent days, TSMC has made it clear that, no matter how much the Trump Administration desires it, there's no way it can get its American production capacity up to 40% of its total output.

Bringing it home

Amid the seemingly disordered international policies and trade negotiation strategies of the Trump administration, one consistent theme has persisted: it seeks to bring advanced chip manufacturing Situated on U.S. Territory. Although President Trump has championed this kind of approach to silicon supply chains and rapid, region-specific access to fabrication, the relocation of chipmaking initiatives isn't exclusively linked to U.S. Interests. We've encountered China develop competitive AI accelerators, and the EU heavily investing within its own efforts.

In the aftermath of the massive AI infrastructure surge in mid-2025, numerous nations have prioritized developing their domestic infrastructure and securing access to semiconductors, both cutting-edge and older, more specialized chips. As it’s become more evident that the future of many economies and national security depends on a steady supply of fast, efficient silicon, producing that hardware domestically carries a lengthy list of Benefits.

In the U.S., this has triggered forceful trade negotiations with China, as each side asserted its leverage—high-end GPU exports for America, and raw materials such as rare earth minerals for China. This is all about establishing the strongest possible foundation in this new competition for AI and semiconductor supremacy. Although in 2026 trade has opened up a little with export licenses and profit-sharing initiatives, the true consequence is China significantly accelerating its development of inference GPUs and ASICs, and the U.S. Seeking to boost reserves of essential rare earth minerals.

It has also pushed the Trump Administration to speed up its domestic chip industry. With a large portion of the world’s expertise and chip manufacturing capacity centered in Taiwan, a key goal of the White House has been to persuade TSMC and its peers to establish operations in the United States.

Along with other companies, TSMC is now undertaking this on a massive scale. Yet the exact magnitude of the investment, along with these newest tariff exemptions, remains vaguely intricate.

Cautious, massive expansion

In the latest Taiwan-U.S. Trade agreement, the U.S. Committed to reducing import tariffs on Taiwanese goods to 15% in return for Taiwanese firms investing $250 billion in the American semiconductor sector. Specifically, it will let them import 2.5 times the new facilities’ planned capacity without tariffs during the construction phase. Companies that have already established capacity in America will get 1.5 times the capacity of those facilities as tariff exemptions.

The notion is that TSMC and other Taiwanese companies investing in the U.S. Will direct their tariff-free chips to hyperscaler AI firms such as Google, Microsoft, Amazon, and Meta. But since the mathematics behind the investment scale and its connection to chip allocations remains unclear, numerous details still need to be resolved. A large part hinges on the fabrication capacity TSMC expects to achieve over the next two years.

To date, TSMC has pledged to invest $165 billion in building chip fabrication capacity in America. It is said to be highly cautious about additional growth, given concerns over an AI bubble and the U.S. Government's own investment in TSMC competition, like Intel. If demand for chip manufacturing drops sharply in a year or two due to a shift in the global development landscape, TSMC could end up with unused production capacity that hasn’t even been activated yet, in a similar Fashion to memory suppliers a few years ago after the pandemic surge.

TSMC and other Taiwanese semiconductor companies are now aligning closely with major U.S. Firms and global governments in their approach to collaborating with the current White House administration. Participating in intricate trade practices is a vital part of securing robust financial and trade prospects in the near term. But the Trump administration’s weaker long-term strategic vision threatens to undermine any companies that depend too heavily on its coercive guidance for extended planning.

Although significant U.S. Investment is on the way, TSMC may need to proceed with caution to steer clear of the risks on both sides of the equation.