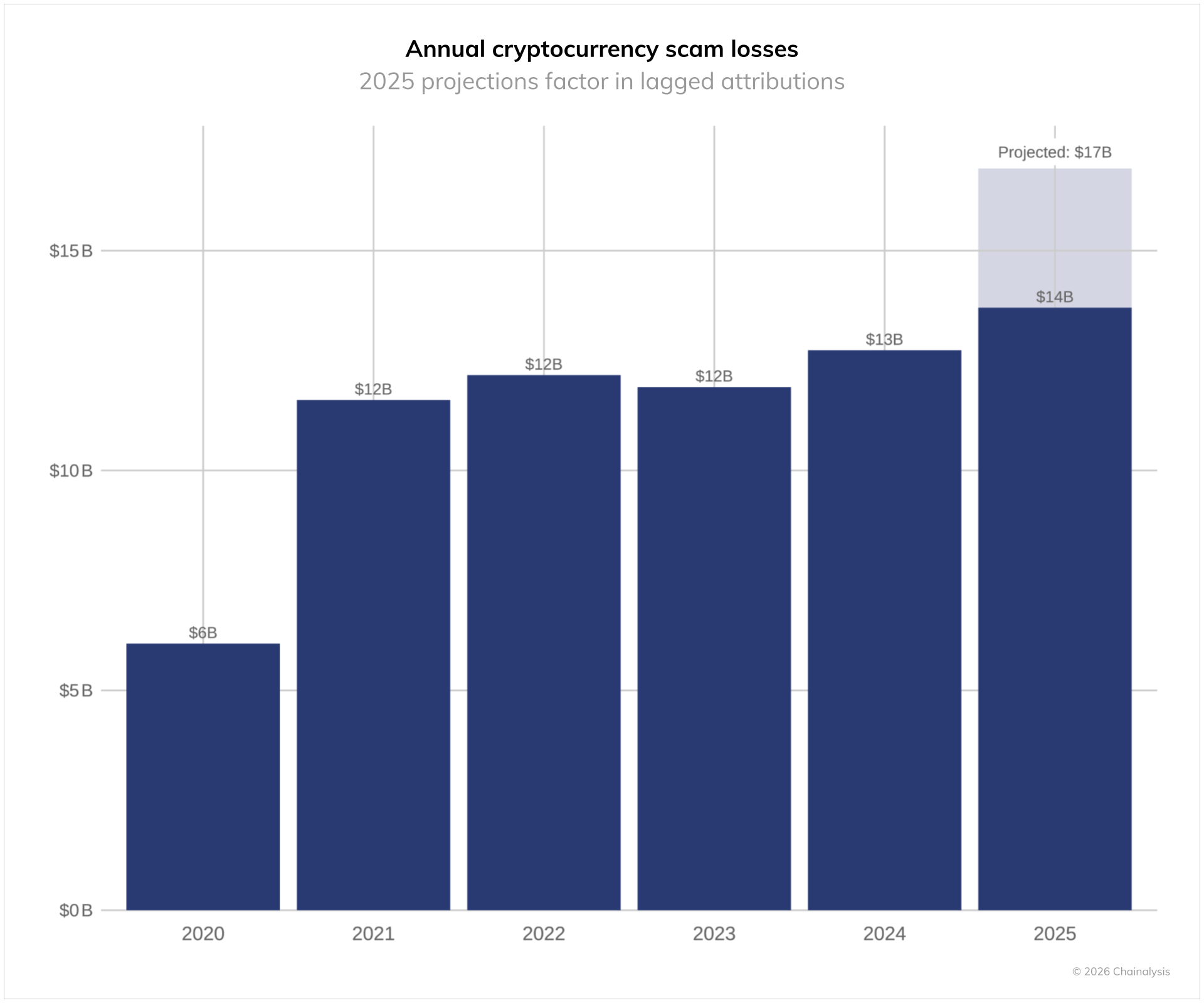

Report estimates $17 billion worth of bitcoin was stolen in 2025 alone —massive haul arises from impersonation tactics and the use of AI for scams

AI-powered scams extracted 4.5 times more revenue compared to traditional con jobs

Get 3DTested's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

2025 represented the largest increase in revenue generated by crypto scams to date with an estimated $17 billion stolen that year alone, Chainalysis reports. The rise of AI-generated deepfakes, phishing, AI-assisted pig butchering, impersonation (including governmental impersonation) and more have all contributed to 2025 being the biggest year for crypto scammers worldwide.

Chainanalysis recorded a 253% YoY increase in average payments from crypto scammers. An average payment in 2024 was worth $782, but in 2025, an average payment is worth $2,764.

In the firm's current analysis for 2025, cryptocurrency scams have received at least $14 billion recorded on blockchains, representing a 34% increase compared to 2024 which saw thefts total $9.9 billion for the lifetime of Chainalysis' tracking. However, due to timing issues between reporting periods, it is expected that the 2025 figure will exceed the aforementioned $17 billion figure.

Impersonation scams are at the heart of the aforementioned 2025 figures. Chainalysis recorded a whopping 1400% growth in impersonation scams in 2025 compared to 2024, with average security payments increasing by over 600% (for each scam, the average amount of stolen crypto increased substantially).

A big part of these impersonation scams is impersonation of governmental agencies. Chainanalysis cites E-ZPass scams as one example of this class of fraud, where scammers used fake texts from America's electronic toll collection systems to scam victims out of $1 billion over three years.

AI-powered scams were significantly more effective in 2025, extracting 4.5 times more money compared to conventional social engineering tactics. Chainalysis revealed that average scams with "on-chain links to AI vendors" extracted $3.2 million per op compared to $719,000 without on-chain links. It also recorded higher daily revenue of $4,838 for AI generated scams and $518 for scams without AI. Transaction volume also increased by 9x with the assistance of AI.

Chainalysis reporting matches other reports of increased fraudulent activity in the cryptocurrency space. A few days ago the FBI warned Americans that crypto ATM scams are on the rise and "not slowing down" after reporting that American's lost $333 million to ATM Bitcoin fraud in 2025 alone. 2025 also saw the largest confiscation of crypto in history when the DoJ seized $15 billion worth of Bitcoin from a Cambodian scammer who ran a pig butchering con using forced labor.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

This problem is only expected to get worse, governments are unequipped to tackle the difficulties of tracking crypto, which in and of itself is designed to be anymous to anyone looking at crypto transactions from the outside. Reports like this serve as a good reminder to always be on the lookout for scams and double-check that the last banking or money request notification you got on your phone is legitimate.

Follow 3DTested on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

-

King_V "But cryptocurrency will make sure the government won't be able to see anything you're doing!"Reply -

TheyStoppedit ReplyKing_V said:"But cryptocurrency will make sure the government won't be able to see anything you're doing!"

Bitcoin's ledger is public. Monero isn't. Monero is a privacy chain where there is no trail. So you can remove bitcoin from bitcoin wallet A, convert it to USDT on exchange, buy monero, then send that monero to a monero cold wallet. Then, send that monero to another exchange, sell it for USDT, but bitcoin, and send that to bitcoin wallet B, and there is no way to know that bitcoin wallet A and bitcoin wallet B are owned by the same person. This is why Monero is kind of known as the money laundering coin, because there is no way to know where it came from. You can trace transactions from one wallet, to the next, to the next, back and back and back.... Until you hit a monero wallet, and the trail stops there. There is no way to trace it back further and so the origins of those funds can never be known.