Applied Materials to pay $252 million penalty for selling chipmaking tools to banned Chinese firm — settles over alleged 56 tool exports to chipmaker SMIC following Entity List designation

Commerce Department subsidiary says ion implanters were partially assembled in Korea and shipped to blacklisted SMIC units.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

The U.S. Department of Commerce has ordered Applied Materials to pay a $252 million civil penalty to settle allegations that it illegally exported semiconductor manufacturing equipment to subsidiaries of Semiconductor Manufacturing International Corp (SMIC) after the Chinese foundry had been placed on the U.S. Entity List.

According to the Bureau of Industry and Security (BIS), the violations involved 56 exports or attempted exports of ion implanter systems and related modules between November 2020 and July 2022. The transactions were valued at some $126 million, with the final penalty set at twice that amount, which Commerce described as the statutory maximum.

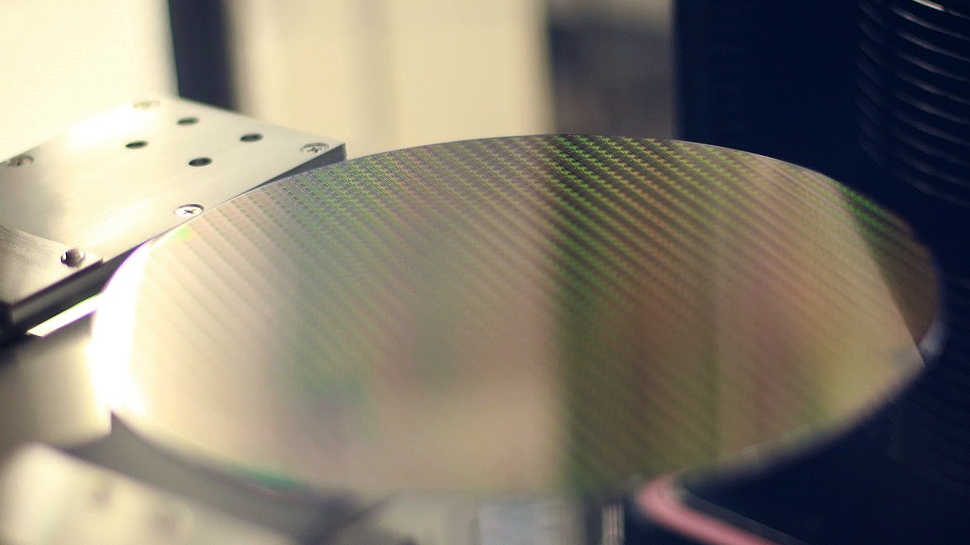

Ion implanters are front-end tools used to dope silicon wafers during transistor formation. While they’re not as fancy as other tooling like EUV machines, they are just as important across a wide range of process nodes, including mature and advanced logic. BIS says that Applied Materials continued shipping the systems to SMIC subsidiaries after receiving an “is-informed” letter from Commerce on September 25, 2020. That letter stated a license was required for certain exports, reexports, or transfers involving SMIC due to military end-use concerns.

In a proposed charging letter released alongside the settlement, BIS outlines what it calls a “dual-build” process. Equipment was partially produced in Gloucester, Massachusetts, transported to South Korea for construction and evaluation, and subsequently sent from Applied Materials Korea to SMIC locations in China. In some cases, factory interface enclosures were shipped separately from Singapore.

The charging letter includes excerpts from internal communications, including one exchange dated the day after the is-informed notice, where a senior executive wrote that the company needed to go into “hyper drive” on its Korea operations. BIS also alleges that internal discussions referenced competitive pressure and the risk of losing SMIC business if shipments were delayed pending license determinations.

The Commerce Department’s order includes a three-year suspended denial of export privileges, which can be activated if Applied Materials fails to comply with payment or audit conditions imposed by the order. The settlement also requires multiple external audits and annual compliance certifications.

In initial reporting, Reuters noted that the U.S. Department of Justice and the U.S. Securities and Exchange Commission have closed related investigations without taking action, and that Applied Materials has not admitted to criminal wrongdoing as part of the civil settlement. The case ranks among the largest standalone export control penalties imposed by BIS to date.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

Follow 3DTested on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

-

hotaru251 ReplyThe transactions were valued at some $126 million, with the final penalty set at twice that amount, which Commerce described as the statutory maximum.

And until this changes they will keep doing it.

When they can easily make the fine back its just the cost of doing business.

Maximum fines need to be scaled off the company's value and/or profit (whichever is greater) since the law was broken so that the fines are ACTUALLY impactful that a company actually gets harmed for more than a quarter or two.