Intel's Arrow Lake Refresh judgment day is reportedly on March 23 — missing Core Ultra 9 290K Plus from U.S. Retailer listings spurs cancellation rumor

Can Arrow Lake Refresh save Intel from AMD's dominance?

Get 3DTested's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Intel has updated its mobile lineup with Panther Lake, which feels like a true next-gen leap in every way, but its upcoming desktop series is a by-the-books iterative upgrade. Arrow Lake Refresh is confirmed to launch this year, and the latest rumor from @momomo_us says that date is March 2026. The review embargo for the initial batch of ARL-R chips is reportedly lifting on March 23.

The Arrow Lake refresh lineup is expected to serve as a stopgap before the next-gen desktop product, Nova Lake, debuts at the end of this year. Each SKU in this release is a more advanced version of the existing Arrow Lake silicon. For instance, the Core Ultra 7 270K Plus has a 24-core configuration—up from 8 P-cores and 12 E-cores on the Core Ultra 7 265K to 8 P-cores and 16 E-cores.

Similarly, the Core Ultra 5 250K Plus is an upgrade to the existing Core Ultra 5 245K, featuring a 6P+12E core configuration that improves on the 6P+8E core layout of the latter. There are minor clock-speed bumps throughout, such as the P-core turbo increasing from 5.2 GHz to 5.3 GHz. Across the Arrow Lake refresh lineup, native CUDIMM RAM support has been upgraded to DDR5-7200.

Core Ultra 7 270K Plus & Ultra 5 250K/KF review embargo at Mar/23, 2026 6AM PST.February 7, 2026

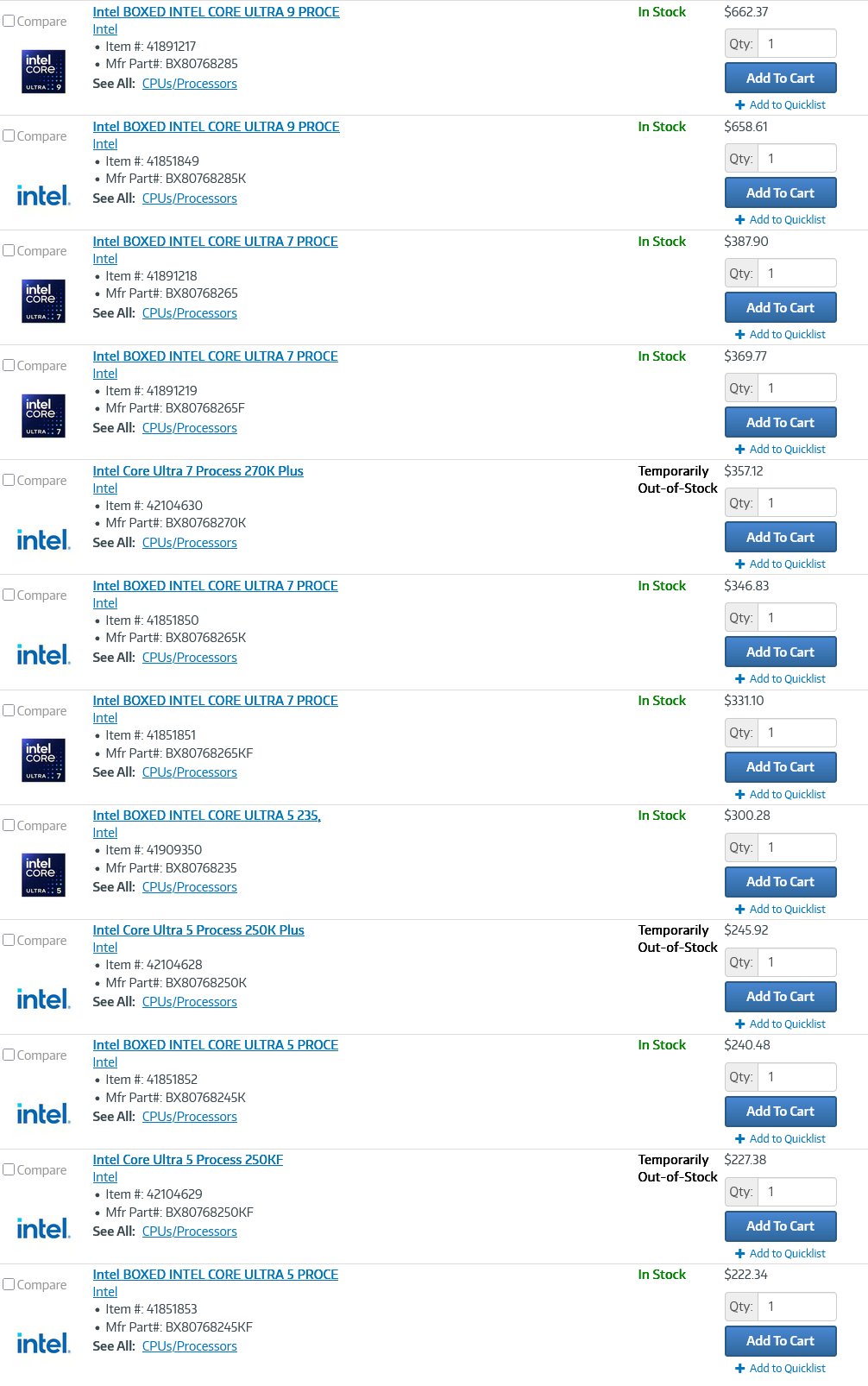

Both the Core Ultra 7 270K Plus and Core Ultra 5 250K Plus also had their prices leaked today, but take these with a grain of salt, as we still have a long way to go before launch, if the rumors are to be believed. The Core Ultra 5 250K Plus was priced at $245.92, while the Core Ultra 7 270K Plus was listed at $357.12 on an undisclosed retailer, shared by @momomo_us. There's also a non-Plus Core Ultra 5 250KF (no iGPU) priced at $227.38.

Compared with the MSRP of the current-gen Arrow Lake chips they'll replace, we see a reduction across the board. The Core Ultra 7 265K, for example, launched at $394, but its successor is listed for just $357. The Core Ultra 5 245K cost $319 when it first came out, while only a $245 ask is mentioned for the 250K Plus. Lastly, the 245KF debuted at $29,4, yet the 250KF is supposedly only $227.

Street pricing for these CPUs is very different: we've seen the Core Ultra 5 245KF on sale for $199 on Newegg (with a free 240mm AIO), while the 265K is discounted to $275 on the same retailer's website. Taking all that into consideration, it's a fool's errand to speculate on pricing, especially given the industry's current volatility — not to mention that these were just one vendor's listings.

The most important takeaway from these two news items is the absence of a Core Ultra 9 SKU, specifically the 290K Plus, which may indicate a staggered launch. The reality is much grimmer, though: Videocardz reports that the chip has been cancelled because the 285K already is a 24-core SKU, so there won't be any real added value.

Get 3DTested's best news and in-depth reviews, straight to your inbox.

Unlike AMD, which offers a simple clock-speed bump with its recent Ryzen 7 9850X3D, Intel doesn't consider a simple clock-speed bump a meaningful enough upgrade to justify a refresh of an existing chip. According to sources close to the matter, the Blue Team doesn't want a "product overlap" with two 24-core chips, so it's been cancelled outright in favor of upgraded Core Ultra 7 and Core Ultra 5 SKUs.

Follow 3DTested on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

-

teeejay94 I truly don't believe they'll be able to translate the laptop gains over to desktop, they've shown time and time again they don't want to make what their customers want to buy they make whatever they want and expect us all to go along with it like some clown show, Intel has always had core fanboys and they rely upon them. 285K was not impressive at all a bunch of E cores packed into a CPU, whoopty doo! Nothing interesting over at Intel, move along!!! Oh what's that AMD? AI? Yeah watch your mouth.Reply -

patriotpa The “290K canceled” claim collapses the moment you look at Intel’s actual uplift history and Arrow Lake’s documented margins.Reply

1. Intel’s historical i9 K → KS uplifts (real‑world):

9900KS: ~5%

10900KS (unreleased): ~4–5% uplift existed, but thermals made it pointless

11900KS (unreleased): ~2–3% possible, node was already at the wall

12900KS: ~5–6%

13900KS: ~5–7%

14900KS (unreleased): ~3–4% possible, curve too flat to justify a SKUAcross five generations, KS uplifts sit in the 3–7% band.

2. Arrow Lake’s top‑end uplift is larger than all of those. Documented deltas:

270K → 285K: ~13%

285K → 290K: ~9–11%These are bigger than any KS uplift Intel has ever shipped.Canceling a top bin with a larger margin than previous KS parts makes no sense.

3. 290K is simply the KS‑class bin of 285K. Same right‑tail silicon, same voltage‑limited uplift — just a different label. Intel folded the KS uplift into the 290K name instead of calling it “285KS.”

4. The yield curve confirms the headroom is real. Arrow Lake’s silicon is flat across ~75% of the stack, with a clean right‑tail where the 290K sits. The performance margin is measurable and already validated.

5. The rumor’s “overlap” argument contradicts Intel’s own SKU behavior. Intel has always shipped ~10% top‑bin uplifts. Arrow Lake’s uplift is larger than that.

Bottom line: The performance margin for 290K is real, documented, and larger than previous KS generations. Calling it “canceled” ignores the silicon, the yield curve, and Intel’s own historical binning pattern.

Quote ReplyReport Edit

A -

bolweval Reply

the thing you didn’t account for that’s different this time around is the new CEO.patriotpa said:The “290K canceled” claim collapses the moment you look at Intel’s actual uplift history and Arrow Lake’s documented margins.

1. Intel’s historical i9 K → KS uplifts (real‑world):

9900KS: ~5%

10900KS (unreleased): ~4–5% uplift existed, but thermals made it pointless

11900KS (unreleased): ~2–3% possible, node was already at the wall

12900KS: ~5–6%

13900KS: ~5–7%

14900KS (unreleased): ~3–4% possible, curve too flat to justify a SKUAcross five generations, KS uplifts sit in the 3–7% band.

2. Arrow Lake’s top‑end uplift is larger than all of those. Documented deltas:

270K → 285K: ~13%

285K → 290K: ~9–11%These are bigger than any KS uplift Intel has ever shipped.Canceling a top bin with a larger margin than previous KS parts makes no sense.

3. 290K is simply the KS‑class bin of 285K. Same right‑tail silicon, same voltage‑limited uplift — just a different label. Intel folded the KS uplift into the 290K name instead of calling it “285KS.”

4. The yield curve confirms the headroom is real. Arrow Lake’s silicon is flat across ~75% of the stack, with a clean right‑tail where the 290K sits. The performance margin is measurable and already validated.

5. The rumor’s “overlap” argument contradicts Intel’s own SKU behavior. Intel has always shipped ~10% top‑bin uplifts. Arrow Lake’s uplift is larger than that.

Bottom line: The performance margin for 290K is real, documented, and larger than previous KS generations. Calling it “canceled” ignores the silicon, the yield curve, and Intel’s own historical binning pattern.

Quote ReplyReport Edit

A -

TerryLaze Reply

It's not like lip is different than any other CEO and doesn't want to make money......bolweval said:the thing you didn’t account for that’s different this time around is the new CEO.

Of course they might hold back the 290k for a later date to maximize sales on the lower tiers first, but canceling it wouldn't make any sense at all, unless tsmc just isn't capable of allowing it to have enough uplift to make it a viable product.