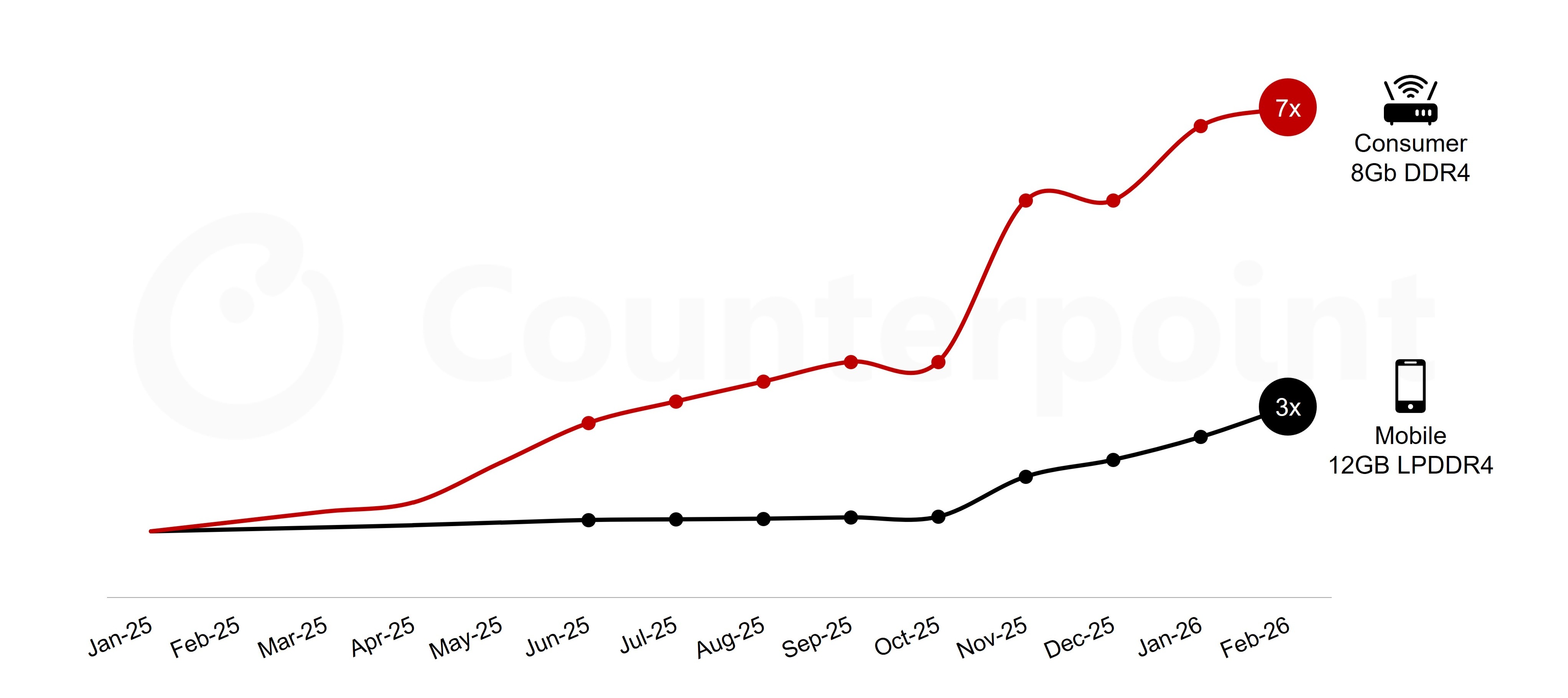

7-fold increase in memory costs drives up pricing for home setups, as rising costs for ISP services impact overall deployment.

There's no escaping the memory black hole.

Receive 3DTested's top stories and detailed evaluations, delivered directly to your email.

You are now subscribed

Your newsletter sign-up was successful

It has long been noted that DRAM prices have been rising, and now their impact is being felt as prices for everyday electronics rise sharply. Admit The newest area impacted is the market for ISP-distributed broadband routers, set-top boxes (STBs), and gateways, which may experience prices for the memory they require rise sevenfold.

Counterpoint analysts indicate that this sharp rise is expected to persist until at least June and will probably remain because of the current supply shortage. While memory formerly represented roughly 3% of the typical bill of materials (BOM) for manufacturing one of these units of hardware, this figure has currently surged to 20%, and it is set to exert a disproportionate effect on the The final price of the equipment

While this likely won't have a direct impact on the monthly price of your internet connection, the usual "free installation" and similar deals, such as a free set-top box, may disappear over time. The chart below illustrates a notable disparity in LPDDR4 costs for mobile devices compared to the conventional DDR4 utilized in consumer-oriented telecom hardware.

As stated by Counterpoint, routers might face the greatest impact, since the manufacturers of such hardware typically lack the specific negotiation power and extended procurement agreements found among the larger market competitors. DDR4 was already being phased out before the crisis hit, and supply constraints forced a surge in prices. The fact that AI-driven features were added didn’t help, as the increased demand strained systems already strained by memory demands.

Industry analysts further observe that this issue could potentially impact ISP fiber rollouts. It's not difficult to foresee that the total cost of the gear turns into a major consideration, particularly when the moment arrives to transfer the charges to customers, who might resist paying for hardware that was frequently "free" For numerous years.

Even major telecom companies are now acknowledging the issue, as even they acknowledge the growing concern. During the announcement of its Q4 2025 outcomes, Nokia's CEO remarked that while "at a macro level across the company, [RAM pricing] is not a huge part", the corporation plans to "safeguard the provision relative to the agreements [it does Possess]" and that "[it anticipates ] to remain passed through to pricing".

Concurrently, MediaTek allegedly indicated that it's obtained sufficient memory for its server requirements, but that for alternative sectors it plans to "modify its rates to account for increasing logistics expenses and distribute our inventory throughout Products driven by profitability, based on overall performance. Likewise, Qualcomm's CEO said that, with data centers as priority #1, "industry-wide memory shortage and price increases are likely to define the overall scale of the handset industry through the fiscal year."

Receive 3DTested's top stories and detailed evaluations, delivered directly to your email.